Council tax harmonisation

Council tax is integral for ensuring the financial sustainability of any new unitary councils.

We understand that ultimately the levels of council tax and speed of harmonisation will be a political decision for the Shadow Authorities. However, all Surrey Councils agree that harmonisation of Council Tax on day one would be the desired position. We have used this assumption in the financial modelling underpinning this proposal.

Day 1 harmonisation would:

- Ensure equity across the new unitaries, with all service users in a new council paying the same rate.

- Maximise income in both year one and every subsequent year

- Comply with the referendum limits on a weighted average basis

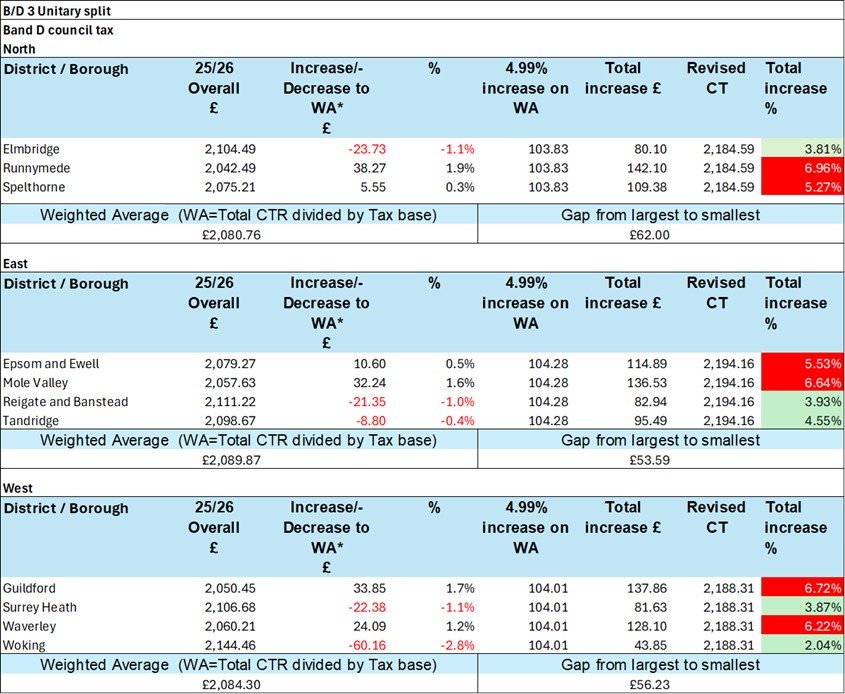

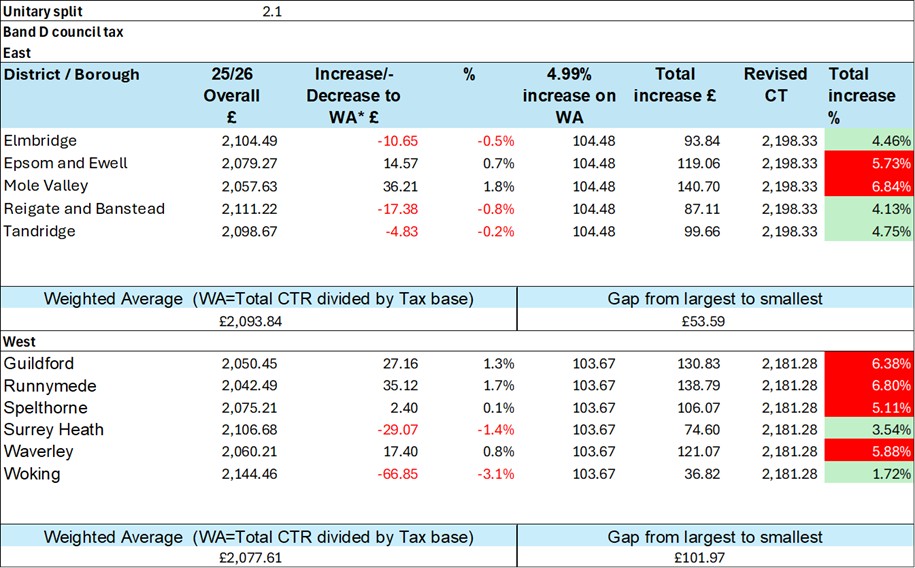

The impact of harmonisation, compared to a 4.99% increase is shown in the tables below.

District and borough – three-unitary summary:

In the three-unitary model, the weighted averages for the new councils would be within £9.11 of each other. The maximum increase for an existing district would be 6.96%.

In the two-unitary modelling, the difference between the new unitaries would only be between £13 and £16. The maximum increase within an existing district area would be 6.84%.

Surrey County Council – two-unitary summary for East/ West option 2.1:

Further consideration is needed regarding the Surrey Fire and Rescue Service, which would require a portion of the Surrey County Council precept to fund its services, affecting all modelling proportionately. Additionally, attention must be given to any newly established Parish and Town Councils in currently unparished areas, as well as any areas with special expenses currently being charged.

This form helps us improve the content and structure of our webpages only, and we cannot provide a response to any submission below.